Analysing Volkswagen Diesel Scandal and E-S-G Spillover Effects with real-time AI

Analysis of the Volkswagen Diesel Scandal and the spillover effects on E-S-G performance with Knowsis ESG scores.

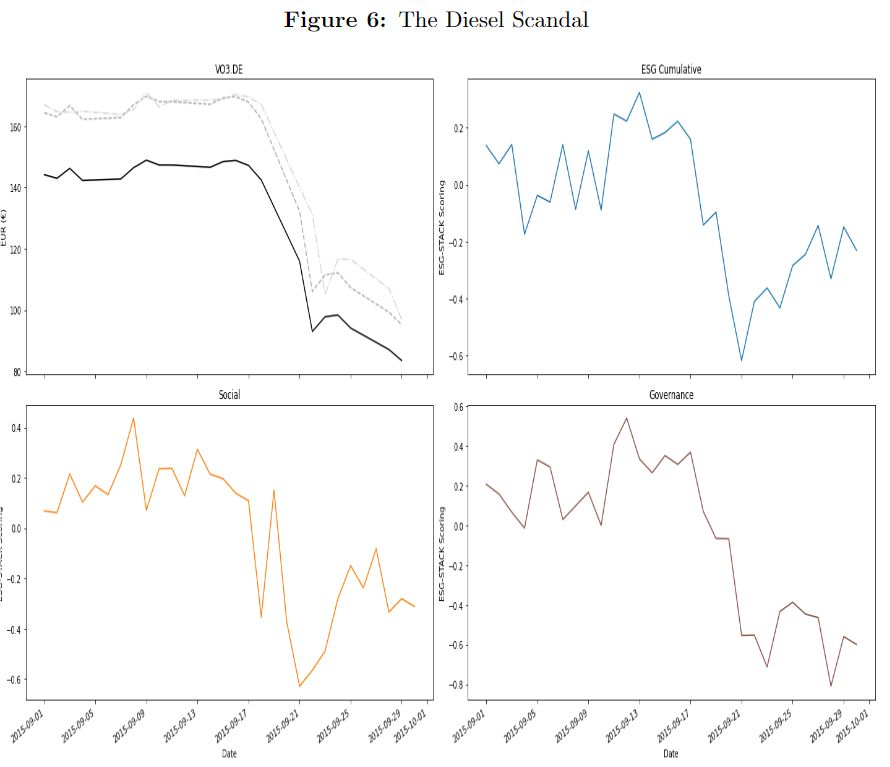

Since we classified such a scandal as a governance topic, we begin focusing on the governance score (fourth quadrant). There is a significant correlation (71%) between the stock price and the “G” score. More importantly, the “G” score severely drops (from 0.25 to around -0.8) 2 days ahead of the stock price. Similarly, the Social score (third quadrant) also dipped due to spillover effects before quickly recovering and stabilizing around -0.2. It is in fact hard to imagine that a corporate scandal doesn’t affect the social dimension of a company. Averaging the “S” and “G” scores, we obtain the ESG score (second quadrant) that collapses ahead of the market sell-off but then recovers more quickly than the stock price, signalling early the stabilization of the market perception of Volkswagen’s failure.

Knowsis is an alternative data company using cutting edge natural language processing and data science to extract value from non-traditional online and social media sources into quantifiable and actionable output for capital markets and businesses.

More applications and integration methodologies are available www.knowsis.com

Liked the article? Share it!